ABOUT GURLEY LTCI – LTC BASICS

Protect What Matters

The new normal is clear: some coverage is better than none. Prepare for life’s uncertainties with the peace of mind that comes from being covered.

ABOUT GURLEY LTCI – LTC BASICS

Protect What Matters

Protect What Matters

The new normal is clear: some coverage is better than none. Prepare for life’s uncertainties with the peace of mind that comes from being covered.

Chances are that you or someone you love

will need long-term care!

Just think about the reasons for needing care.

They range from cognitive diseases like Alzheimer’s to physical limitations from accidents.

Or medical conditions like ALS, cardiovascular disease, diabetes, MS, and more.

Chances are that you or someone you love will need long-term care!

Just think about the reasons for needing care.

They range from cognitive diseases like Alzheimer’s to physical limitations from accidents.

Or medical conditions like ALS, cardiovascular disease, diabetes, MS, and more.

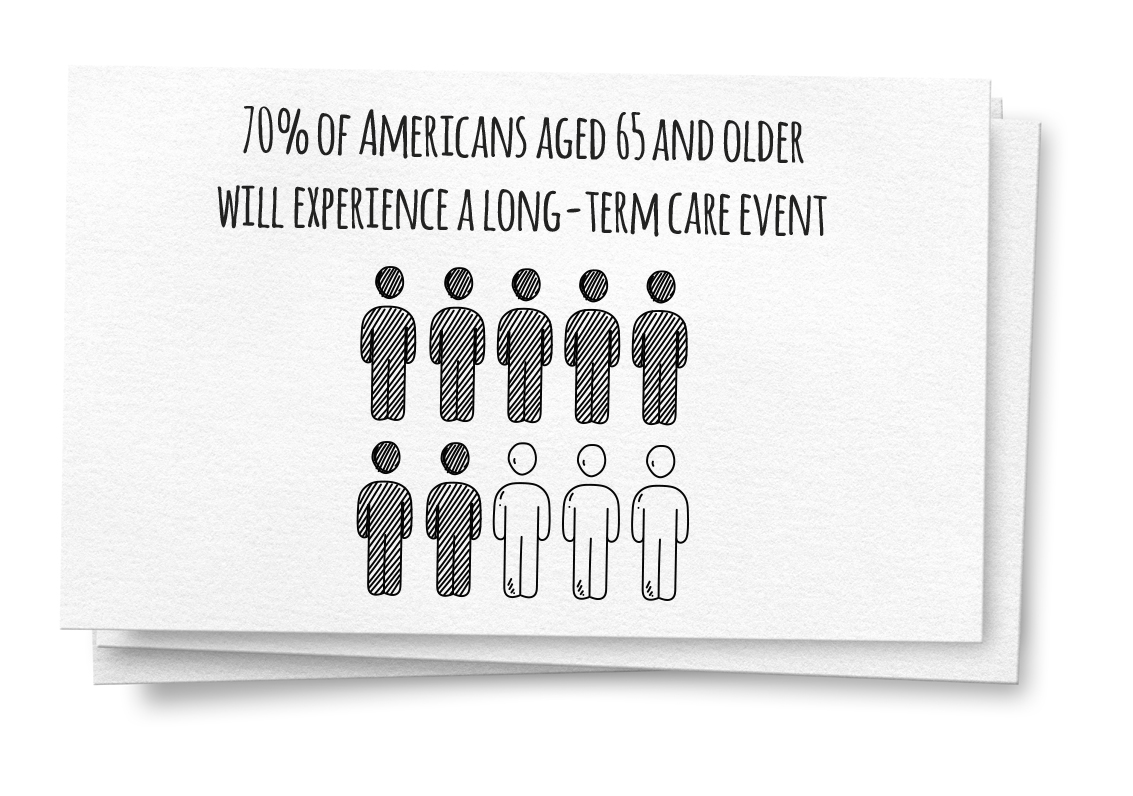

Government projections show that most people who reach age 65 will need long-term care as they age.

Long-term care is custodial in design. This care assists with activities of daily living including bathing, dressing, eating, toileting, continence and transferring. It also provides supervision for cognitive impairment. It is very different from health care and Medicare which are programs designed to cure or rehabilitate medical conditions.

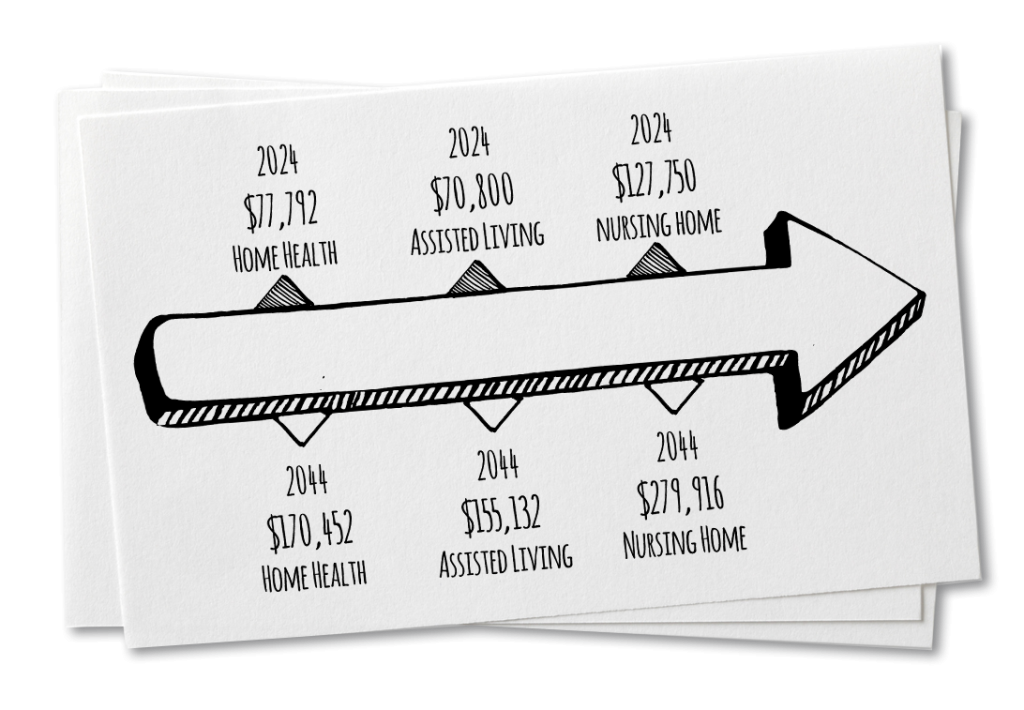

No matter what kind of care you want to secure, the costs are quickly rising and are projected to double in 2043 compared with 2023.

Source: Genworth Cost of Care Survey

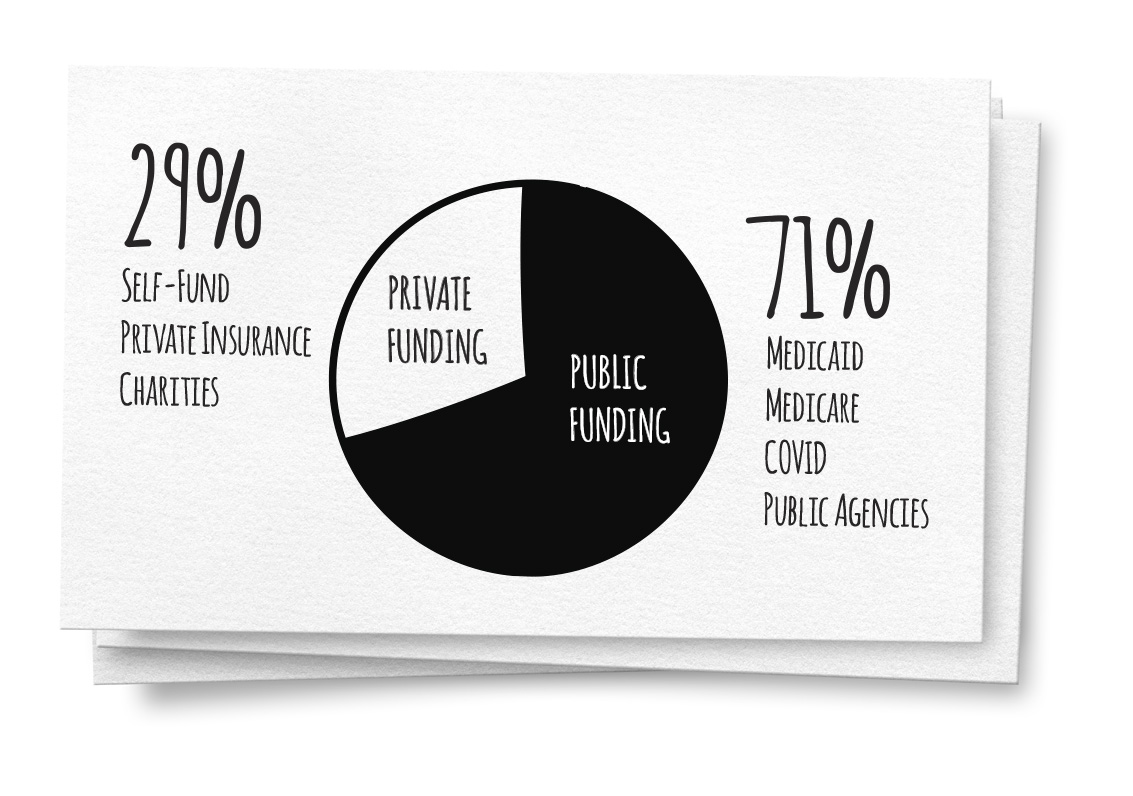

There are three funding options: Self-Funding, Government assistance (Medicaid), and Long-Term Care Insurance.

Long-term care insurance is designed to help protect you and your family from the financial, physical and emotional impoverishment associated with long-term care needs. Today’s comprehensive policies pay for a wide range of caregiving services in most settings: your own home, adult day care centers, assisted living communities, memory care centers, nursing homes and hospice.

How will you pay for this care without compromising your family’s standard of living or retirement portfolio?

These three questions will help you plan for long-term care:

1. WHERE would you want to live if you needed care?

2. WHO would you want to provide your care?

3. HOW would you pay for the care you may need?