GURLEY LTCI – PRODUCTS

Transferring The Risk

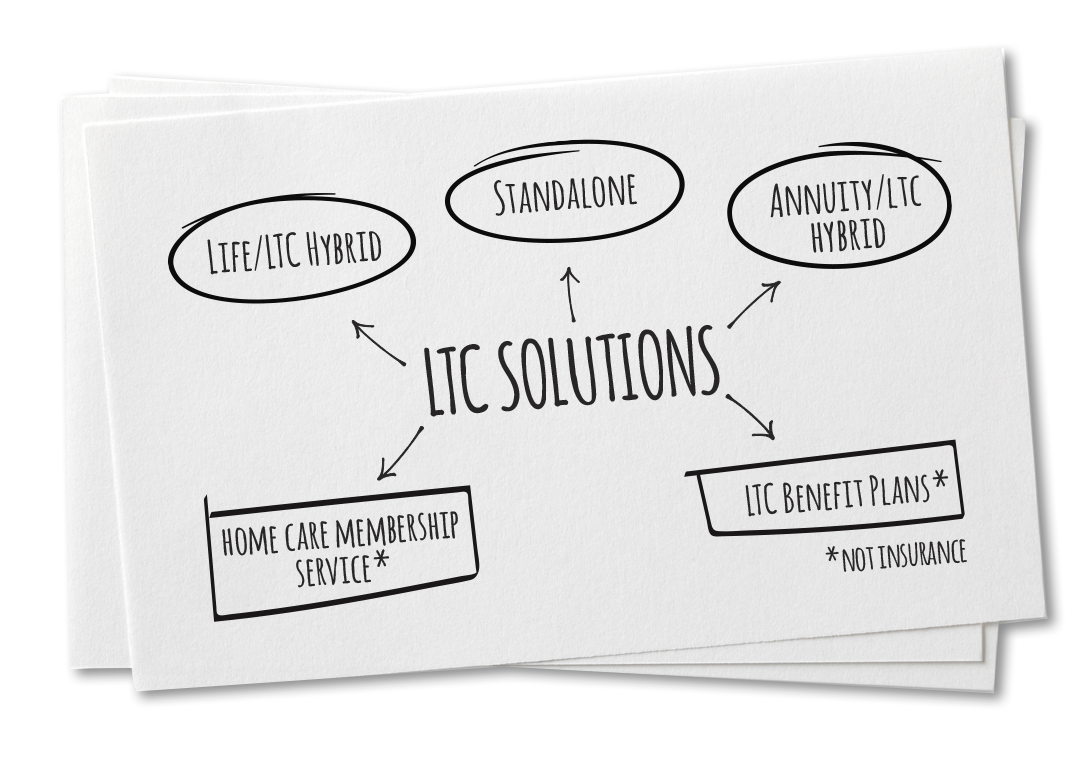

Safeguard your assets and income from long-term care expenses by transferring the risk to an insurance company. Learn more about the three insurance products and two alternate, non-insurance options to create your plan.

GURLEY LTCI – PRODUCTS

Transferring The Risk

Safeguard your assets and income from long-term care expenses by transferring the risk to an insurance company. Learn more about the three insurance products and two alternate, non-insurance options to create your plan.

Standalone products are appropriate for young, healthy applicants.

Most standalone or pool-of-funds products are tax-qualified which means benefits paid are not taxable and premiums may be deductible depending on how policyholders file taxes.

These are integrated plans that cover services in all long-term care venues: home care, adult day care, assisted living, memory care, nursing home and hospice.

Numerous top-rated carriers offer these highly customizable products. A wide range of riders is also available to meet the likes and needs of clients, couples, small business owners, professional organizations and large employers.

It is this product design that offers partnership policies that provide additional safeguards from Medicaid resource reduction requirements.

These products are available from age 18 through 79 and may be more appropriate than asset-based products for those under age 65. They have the strictest underwriting requirements. However, some carriers will issue policies to less healthy applicants at higher than standard premiums or with limited coverage.

These products are often referred to as the “pay as you go” model. Think about auto or homeowner’s insurance when you think about this product design. You figure out how much coverage you need, what you want your deductible to be and pay premiums hoping that you’ll never need the benefits of the policy.

Most policyholders pay premiums annually for their lifetime or until they become eligible for benefits.These policies are guaranteed renewable which means that rates can increase during the life of the policy if an increase in a specific state is approved by that state’s insurance commissioner.

If clients need care, these policies are generally the least costly insurance solution.

Life insurance-based LTCI solutions are designed for an older market.

Life insurance-based long-term care solutions are referred to as asset-based or hybrid products. They ride on a permanent life insurance chassis versus term life.

These product designs are integrated plans and cover services in all care venues. Fewer options are available to customize these products. Some carriers offer these products to those 20 through age 80. Others target an older audience of 35 through 80.

These products are attractive to older applicants for a couple of reasons: 1) inflation protection becomes less critical when purchased at older ages thus reducing the cost and 2) older applicants may have cash value in other financial vehicles that can be transferred to fund a LTC policy without creating a taxable event. (This transfer of funds opportunity is outlined in the Pension Protection Act of 2006 and became effective in 2010.)

When describing these insurance options, we like to say, “Live, die or quit, there is a benefit.”

- If care is needed the payment of the death benefit can be accelerated while living to pay for long-term care expenses.

- If the policyholder dies never needing care, his/her estate receives a tax-free death benefit.

- If the policyholder quits the policy, he/she will receive a refund of the current cash value of the policy depending on the carrier and product design.

Many clients who are insurance averse like this product design because it eliminates the “use it or lose it” proposition of the standalone pool-of-funds products.

The life insurance-based solution has several designs. One simply uses the death benefit to pay for long-term care expenses. For example, a death benefit of $100K could be accelerated at 2% creating a long-term care benefit of $2000 per month until the death benefit is exhausted. If the death benefit is not exhausted, any remaining amount would be paid to the insured’s beneficiaries.

Another design accelerates the death benefit and also extends benefits when the death benefit is exhausted. With this design there are two funding resources for long-term care expenses: 1) the death benefit and 2) the continuation or extension of benefits rider.

Product designs differ here. Some continuation riders are purchased as separate policies and bound to the life insurance policy. Others are integral to the product design and leverage the single premium to enhance the long-term care benefit pool.

Many carriers offering this product design also offer premium payment options such as annual premiums, 10-pay, 20-pay or a single premium.

The premium creates cash value and may also earn interest, which explains the asset-based design of this product.

Most of these products must be funded with after-tax dollars. But there is an opportunity to fund with qualified funds from an IRA or 401(k) and spread taxes over a 10-year period.

If clients need care, these policies are generally a more costly insurance solution than the standalone pay-as-you-go designs.

Annuity-based LTCI solutions must be Pension Protection Act (PPA) compliant.

These annuities are medically underwritten and carriers offering these products must have claims departments and be in the business of paying long-term care benefits. There are only a few of these products in the market today.

These, too, are integrated plans and cover services in all venues. As with other asset-based products, options are limited. These products are designed for an older client between ages 40 to 85 and have the most lenient underwriting requirements.

Provisions of the PPA allow a 1035 exchange from a non-qualified deferred annuity to a compliant annuity. Funds used to pay for long-term care are no longer viewed as taxable income but considered a reduction of cost basis.

“A reduction of cost basis” means that distributions from the policy are non-taxable and reduce the owner’s cost basis in the contract. Even gain in the old annuity is considered non-taxable if the withdrawal is made to pay for covered long-term care expenses. Withdrawals for other purposes are taxable.

Similar to life insurance solutions, PPA annuities have two designs. One uses the annuity cash value to pay for long-term care expenses and credits withdrawals for covered expenses at a higher interest rate.

Funds can be withdrawn for other purposes, but the crediting interest rate is lower and these transactions are taxable. An extension of benefits rider can be added to this design to continue benefits once the annuity is exhausted.

In the second design the extension of benefits is integral to the product design and allows greater leverage of the premium to create a more robust long-term care benefit.

The advantage of these annuities is that they may be funded from existing non-qualified deferred annuities with a 1035 exchange and provide clients with significant tax savings. This makes it very easy for clients to exchange one policy for another that will provide both long-term care and tax benefits.

If clients need care, this is generally the costliest insurance solution but is often the best solution for older clients with health challenges.

Not everyone who wants long-term care insurance can qualify for it.

If this is the case, we can assist you with alternate funding strategies.

Home Care Membership Service

This is not insurance. And it is not medically underwritten. You just cannot be receiving home care at the time of application. The membership service deeply discounts the hourly cost of home care. You can use nationally recognized home care companies or designate your own caregiver. There are no triggers to eligibility. Like insurance you must apply for membership before care is needed.

Long-Term Care Benefit Plan

Another option is converting an in-force life insurance policy to a long-term care benefit account. This involves selling the life insurance at fair market value through a life settlement transaction and depositing the proceeds into an irrevocable, FDIC-insured Long-Term Care Benefit Plan that is professionally administered with tax-free payments made monthly on your behalf. There is no age requirement, waiting period, care limitations, cost to apply, requirement to be terminally ill or premiums. This is a strategy if you are already receiving care or will need care within about 90 days.

A Long-Term Care Solution Designed For You

A Long-Term Care Solution Designed For You

Find out which insurance products you are likely to qualify for and which are appropriate to secure your financial future today!